Have you ever wondered how your driving habits affect your car insurance premiums? Progressive’s Snapshot plug-in device has been making waves by offering personalized insurance rates based on real driving behaviors. If you’re someone who wants to take advantage of this technology or you’re just curious about how it works, you’ve come to the right place!

In this article, we’ll explore the Progressive Insurance Snapshot plug-in device flash codes list 2019, shedding light on how it functions, what the flash codes mean, and how it can impact your driving experience and insurance rates. By the end of this article, you’ll not only understand the key aspects of the device but also gain insights into how to make it work in your favor, ultimately saving you money on your insurance premiums.

Let’s dive deep into the world of Progressive’s Snapshot plug-in device and flash codes, unraveling the mysteries behind the data it collects and how it influences your rates. Ready to learn how to become a smarter driver and save on car insurance? Let’s get started!

What is the Progressive Snapshot Plug-in Device?

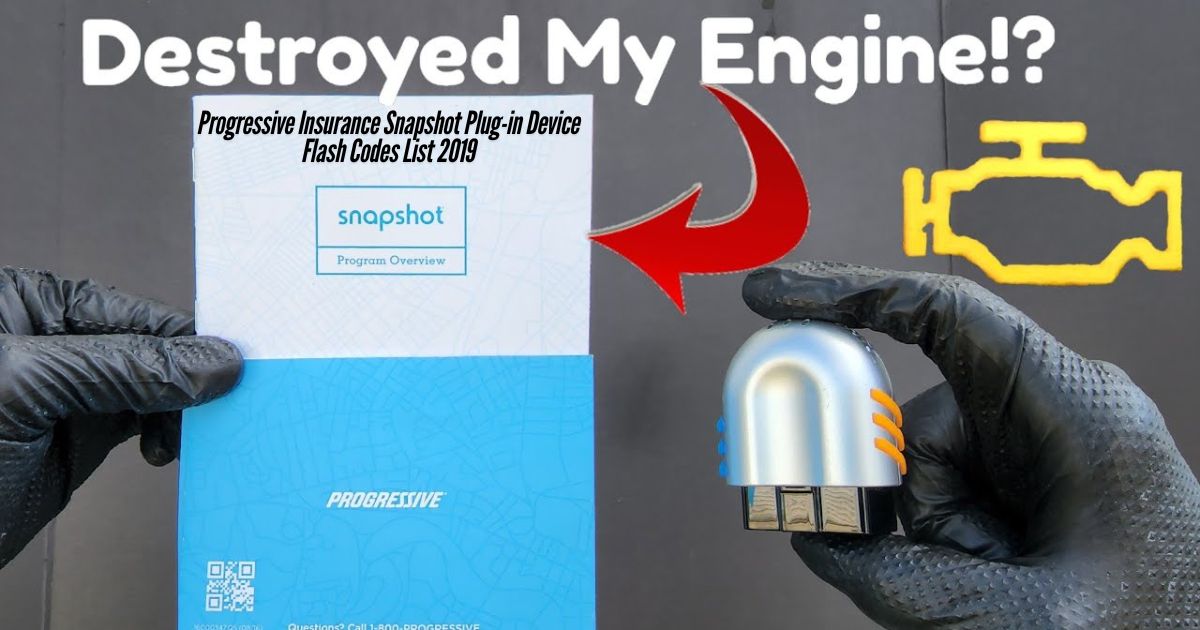

Progressive’s Snapshot plug-in device is a tool that connects to your car’s OBD-II (On-Board Diagnostics) port to track driving behavior. This device collects data like how hard you brake, how fast you drive, and whether you drive at night. Based on the information collected, the Snapshot device provides a snapshot of your driving habits, which Progressive uses to adjust your insurance premium.

The idea behind the Snapshot device is simple: the safer you drive, the less you pay for insurance. It offers a tailored rate, giving you the opportunity to reduce your monthly premiums by driving safely. But how does it achieve this? That’s where the flash codes list comes in.

Understanding Flash Codes and Their Significance

Flash codes are specific indicators or error messages generated by the Snapshot plug-in device. These codes help both the driver and Progressive’s system identify potential issues with the device or its connection to your car. They can also indicate specific driving behaviors that the device is tracking.

Here’s a brief overview of how flash codes work:

- A green flash code indicates that the device is functioning properly and is actively collecting data.

- Yellow Flash Code: Signals that the device has encountered an issue, such as an incomplete data transmission.

- Red Flash Code: Indicates a serious issue, like a malfunctioning device or a connection problem.

- Flashing blue or purple: may indicate the start of a new session of data tracking.

Understanding these flash codes can help you troubleshoot any problems you might encounter with your device and ensure you’re maximizing the benefits of using the Snapshot plug-in.

The Flash Codes List: 2019 Version

Below is the Progressive Insurance Snapshot plug-in device flash codes list 2019, which provides specific meanings for each code displayed by the device:

| Flash Code | Meaning |

|---|---|

| Green Flash Code | Device is working correctly. Data is being transmitted. |

| Yellow Flash Code | Device is experiencing issues (data not fully transmitted). |

| Red Flash Code | Serious malfunction or connection failure detected. |

| Flashing Blue | A new session of tracking has begun. |

| Flashing Purple | Error or issue with starting a new session. |

| Steady Blue Flash | The device is collecting data but has not completed a full cycle. |

| Blinking Yellow | Temporary communication loss with the car’s system. |

If you encounter any of these flash codes, it’s essential to act quickly. For example, a red flash code may require immediate attention to avoid potential interruptions in your data collection and could impact your insurance rates.

How the Snapshot Plug-in Device Affects Your Insurance Rates

The main purpose of the Snapshot device is to track how safely you drive. Here are some key ways it can impact your Progressive insurance premium:

- Safe Driving Rewards: If the device detects safe driving habits—such as gentle braking, moderate speeds, and minimal nighttime driving—you may qualify for lower rates. The device tracks your driving behavior in real-time, offering personalized pricing.

- Driver Behavior Evaluation: Progressive looks at your average speed, frequency of hard braking, and whether you drive more safely during the day. Based on these patterns, they calculate an optimal rate for you.

- Initial Discount: Even before you start collecting data, Progressive may offer an initial discount for enrolling in the Snapshot program. This discount will be adjusted based on the data the device collects over time.

- Driver Feedback: As the device tracks your driving, you may receive feedback from Progressive on how to improve your driving habits to qualify for a better rate. This may include tips on reducing hard braking or avoiding driving during high-risk hours (like late at night).

Advantages of Using the Progressive Snapshot Device

- Personalized Rates: One of the main benefits of using Snapshot is the ability to receive insurance rates tailored to your actual driving behavior. If you drive safely, you can enjoy significant savings.

- Transparency: The device provides you with real-time data on your driving habits, so you can see exactly how your actions impact your insurance rate.

- Potential for Lower Premiums: If you consistently exhibit safe driving patterns, you can expect to see a decrease in your monthly insurance premium over time.

- Improved Driving Habits: Knowing that your driving is being monitored can encourage better habits. This includes braking more gently and reducing your speed, leading to safer roads for everyone.

User Experience: A Real-Life Example

Imagine Sarah, a 30-year-old professional who drives to work every day. She signed up for Progressive’s Snapshot program to save on her car insurance. After installing the device, Sarah noticed that her car’s OBD-II port flashed yellow at first, signaling that data wasn’t being transmitted correctly. After a quick call to Progressive’s customer service, they confirmed that the device had a minor issue that was easily fixed.

As Sarah continued using the device, she noticed her driving habits were being tracked in real time. Her efforts to drive more cautiously during rush hour and avoid sudden stops resulted in a steady decrease in her premium, with the device flashing green—indicating everything was working as it should.

Sarah now pays significantly less for her car insurance, and she enjoys the peace of mind knowing her driving habits are being tracked. By using the Progressive Insurance Snapshot plug-in device flash codes list 2019, Sarah was able to optimize her insurance costs based on her actual driving behavior.

Actionable Tips for Maximizing the Benefits of the Snapshot Device

- Drive Safely: It may sound obvious, but driving safely will lead to the best possible results. Avoid sudden braking, speeding, and nighttime driving to ensure the device records positive data.

- Regularly Check Flash Codes: If you notice a yellow or red flash code, address the issue promptly. This will ensure you get the most accurate data collection and prevent any interruptions in your savings.

- Review Your Data: Some users report that checking their Snapshot data regularly through the Progressive app can help them stay aware of their driving habits and adjust accordingly.

- Be Patient: The Snapshot device doesn’t provide instant results. It takes time to collect enough data for Progressive to offer meaningful discounts.

FAQs

1. What is the Progressive Snapshot device?

The Progressive Snapshot device tracks your driving behavior and helps determine your insurance rate based on how safely you drive.

2. How does the Snapshot device affect my insurance?

By tracking your driving habits, the Snapshot device allows Progressive to offer personalized rates based on how safely you drive.

3. What do the flash codes mean?

Flash codes are indicators that show whether the device is functioning correctly. They help identify issues such as data transmission problems or connection issues.

4. Can I remove the Snapshot device once I’ve enrolled?

You can remove the device after the tracking period, but removing it too soon may impact the discount you’ve earned.

Conclusion

In conclusion, the Progressive Insurance Snapshot plug-in device flash codes list 2019 provides essential insights into your driving habits and helps you save money on your car insurance. Understanding how the device works, how to interpret the flash codes, and how to drive safely can unlock significant discounts on your insurance premiums.

Ready to take control of your insurance rates? Start using Progressive’s Snapshot device today and enjoy the benefits of safer driving and lower premiums. Have you used the Snapshot device before, or are you planning to try it? Share your experience or thoughts in the comments below, and don’t forget to check out our other helpful articles to further enhance your driving experience!

Final Thoughts

To wrap up, remember that every flash code on your Progressive Snapshot device tells a story about your driving habits. By staying proactive and adjusting your driving to get the best results, you not only save money but also become a safer, more aware driver. So, what are you waiting for? Take charge of your insurance rates today, and feel free to share this article with others who might benefit from learning about the Progressive Insurance Snapshot plug-in device flash codes list 2019! Drive safe, save smart, and keep shining!